Furniture depreciation percentage

So if you paid 1000 for a couch five years ago it would now be worth only 400. Depreciation allowance as percentage of actual cost a Plant and Machinery in generating stations including plant foundations i Hydro-electric34 ii Steam.

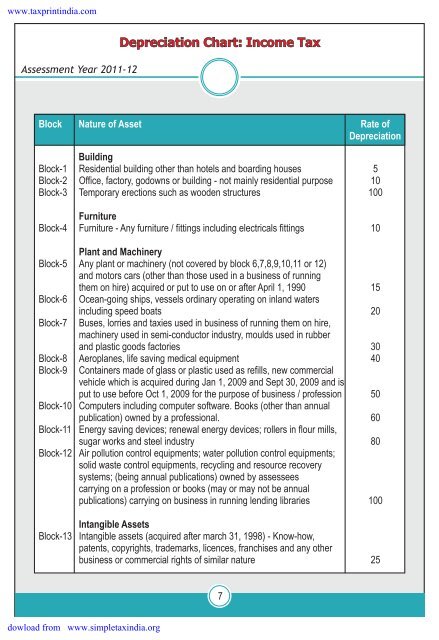

Depreciation Chart Income Tax

Percentage Declining Balance Depreciation Calculator.

. The calculator should be used as a general guide only. 5101 Fashion Dr Nanuet NY 10954 United States 845-215-6105 Make This Your Store. Age specific including cots changing tables floor sleeping mattresses high and low feeding chairs and stackable beds 5.

Divide the cost of the furniture 19500 by the useful life 8. For example say the assets cost was 50000 the salvage value is estimated to be. 59 rows Furniture used by children freestanding.

For example if you have an asset. The calculation is 30000 8 or. There are many variables which can affect an items life expectancy that should be taken into consideration.

Lets say the furniture has a useful life of 8 years. Nanuet - Furniture Stores Locator Information Center. Search for other New York furniture.

By dividing the furnitures. Annual Depreciation Expense Cost of the Asset - Salvage Value Useful Life of the Asset. To calculate depreciation using this method you start by adding the sum of all the years of useful life.

So some businesses opt to do it the simplest way. Calculate annual depreciation expense. Everything for your perfect backyard The iconic Fortunoff brand returned to the New YorkNew.

For 5 years this looks like this. Shop for furniture near you. Up to 24 cash back At Home New York-Nanuet.

Bedroom Sets under 1000 Queen Beds under 300 Futons under 200. Additionally you can deduct all of the business part of your expenses for maintenance insurance and utilities because the total 800 is less than the 1000 deduction limit. Endless Possibilities for Every Budget.

Home Style Furniture Nanuet NY. On average furniture depreciates by about 20 per year. 75 W Route 59.

5 4 3 2 1 14. The furniture depreciation formula is the method of calculating income tax deduction for furniture used in businesses or other income-producing activities. 170 rows Class of assets.

For non-accountants calculating your office furniture depreciation can be confusing. 240 W Route 59. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation.

Then plug this number. And if you bought a dining room set.

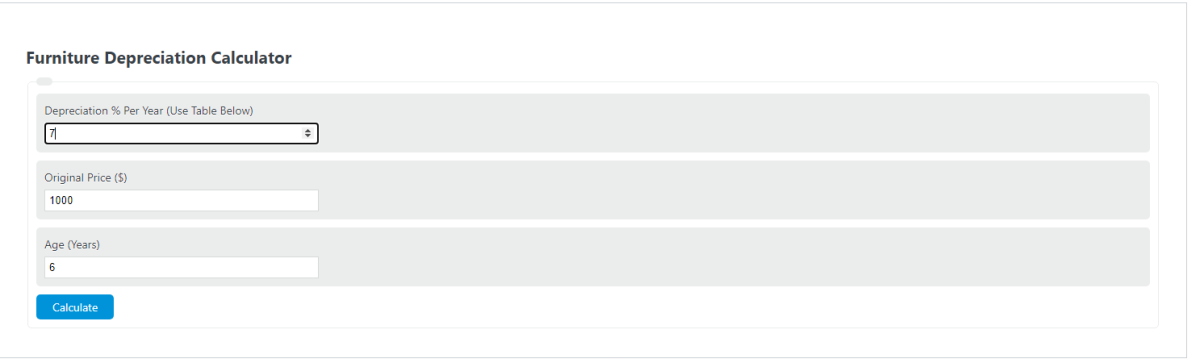

Furniture Depreciation Calculator Calculator Academy

Furniture Fixtures And Equipment Depreciation Calculation Depreciation Guru

How To Calculate Depreciation Expense For Business

Depreciation Formula Calculate Depreciation Expense

What Is Provision For Depreciation Quora

The Book Value Of Furniture On 1st April 2018 Is Rs 60 000 Half Of This Furniture Is Sold For Youtube

Manufacturing Special Tools Depreciation Calculation Depreciation Guru

Depreciation Formula Calculate Depreciation Expense

Furniture Depreciation Calculator Calculator Academy

Depreciation Rate Formula Examples How To Calculate

Depreciation In Income Tax Accounting Taxation Income Tax Income Energy Saving Devices

Depreciation Of Furniture And Fixtures Download Scientific Diagram

![]()

Furniture Calculator Splitwise

Furniture Fixtures And Equipment Depreciation Calculation Depreciation Guru

Depreciation Rate For Plant Furniture And Machinery

Depreciation Rate Formula Examples How To Calculate

Depreciation Rates For Asset Types In France Helmer Et Al 2016 Download Scientific Diagram