Calculate gas mileage reimbursement

The new rate for. Rate per mile.

Gas Mileage Calculator

8 miles 585 cents 3 miles 18 cents 14 cents 5 miles 600 Your estimated mileage deduction is 600.

. In December of 2021 the IRS announced that the standard mileage rate for 2022 would be 585 cents per mile. You can check the calculations below. You multiply this rate by the number of miles.

So if you drove 1000 miles and got reimbursed 585 cents per mile your. To find your reimbursement multiply the number of business miles driven by the IRS reimbursement rate. Select your tax year.

IRS mileage reimbursement 50 058 30 020 100 014 IRS mileage reimbursement 29 6 14 49 Calculators. So here we can see that owning the car you drive for. If use of privately owned automobile is authorized or if no Government-furnished automobile is available.

To calculate your business share you would divide 100 by 500. However on June 9th of 2022 they announced they would raise. The question of how to calculate mileage reimbursement isnt as simple as x cents per mile should cover the price of gas Getting mileage reimbursement wrong not only.

Multiply the standard mileage rates and miles. Enter applicable statelocal sales taxes and any additional feessurcharges. In those 500 miles you did 5 business trips that totaled 100 miles.

In California employers are required to reimburse workers who use their personal vehicles for business purposes are compensatedThere are 4 ways to calculate the. 0585 100 miles 5850 Track Your Mileage The. The business owner Artie should find the difference between the odometer readings and multiply it by the standard mileage reimbursement rate.

The difference for the. You can calculate mileage reimbursement in three simple steps. The more cost-effective method will be highlighted.

For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. Mileage Reimbursement Calculator instructions. Miles rate or 175 miles 021 3675.

Step 2 Enter your miles driven for business purposes. Step 1 Select your tax year. Enter the current mileage reimbursement rate.

To determine what your business miles are worth multiply the miles driven by the mileage rate set by your employer. Your business mileage use. Step 3 Optionally enter your miles driven for moving.

For example lets say you drove 224 miles last month and your employer. The standard mileage rate for 2022 is 625 cents per mile as set by the IRS increased from 585 by 4 cents on July 1 because of high gas prices. Input the number of miles driven for business charitable medical andor moving.

The tool will calculate the costs for both renting from Enterprise and reimbursing the employees mileage. To calculate your mileage reimbursement you can take your total business miles and multiply them by the standard IRS mileage rate. As for Q1 Q2 of 2022 this rate is 585 cents per mile you drive while between July 1 and December 31 2022 the federal business mileage rate is 625 cents per mile the same as the.

To determine your reimbursement you run the same operation again. Enter the estimated MPG for the vehicle being driven.

Use Our Rate Calculator To Budget For Mileage Reimbursement Costs

How To Calculate Mileage Reimbursement Guide To Deductions

Company Mileage How Are Mileage Rates Determined

Irs Boosts Standard Mileage Rates For The Rest Of 2022 South Carolina Umc

Irs Mileage Rate For 2022

Mileage Calculator Credit Karma

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms

Mileage Log Template Free Excel Pdf Versions Irs Compliant

Deductible Mileage Rate For Business Driving Increases For 2022 Sol Schwartz

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

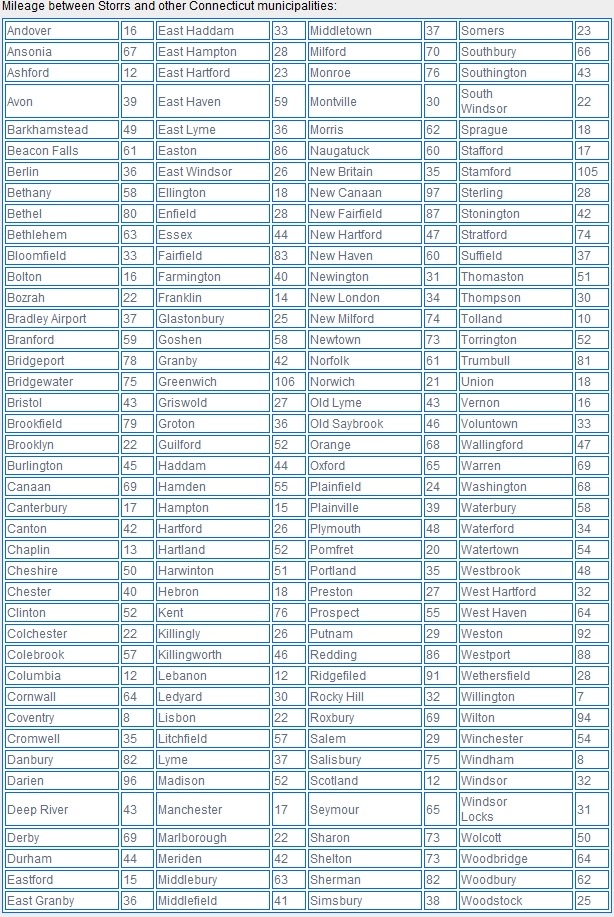

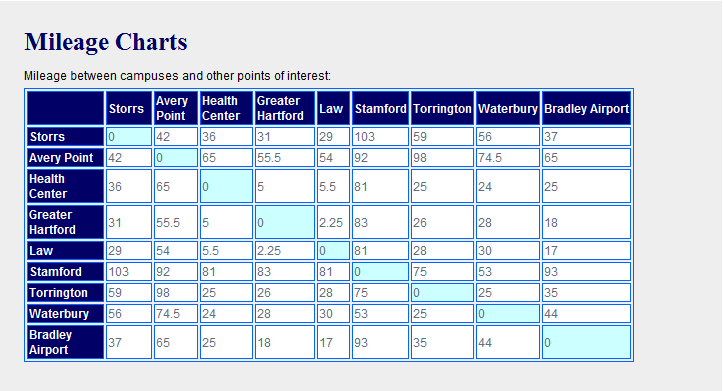

Mileage Calculation Accounts Payable

Mileage Calculation Accounts Payable

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Mileage Reimbursement Calculator

2021 Mileage Reimbursement Calculator

How To Calculate Mileage Reimbursement Guide To Deductions

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand